What are the returns on Urbanitae?

This is a key concept of investments, and almost of life in general. The idea of profitability, or that something pays off, is so widespread that we often use it on a day-to-day basis. For example, to decide if it pays to read this article: I hope so. We won’t steal much of your time.

The first thing we will clarify is what is that profitability of an investment. You may have seen it mentioned as ROI (return on investment). It is the money you earn, yes, but more specifically we talk about the return or benefit that an investment generates with respect to its costs. It is a ratio, often expressed as a percentage, that summarizes whether an investment is going well or not. It is also useful because it allows you to compare it with other investments.

Another variable you may have heard of is CAGR. It is closely related to the concept of compound interest, which we have already addressed on other occasions. The compound annual growth rate (CAGR) takes into account, precisely, reinvestment. That is, it shows the profitability that would be obtained if the profits obtained each year were reinvested again in the same product.

When we talk about profitability in the real estate sector, we usually refer to cash-on-cash. Although they are not equivalent, with the CoC we refer to the total or final profitability of a project: that is, the benefit it has generated once all its phases have been completed. It is, for example, the percentage we use when we talk about projects in Urbanitae.

But, as we know, CoC profitability, per se, does not tell us much if it is not accompanied by the deadline. A product that gives a 50% profitability can seem very attractive. Knowing whether it is or not will depend on how long it takes to achieve that profitability, that is, the term. If it’s a year, it may be too good to be true; If it is after 10 years, it is not bad, but it is not the same: it would be equivalent to 5% per year, which many would like, but it impresses less.

That is why it is essential to refer to the terms of the investment. The most common way is to reference the profitability to the calendar year. That is the real litmus test of investments: what benefit, if any, they give after a year. This indicator allows us to better plan the investment strategy and have an idea, even if it is always approximate, of how our investment portfolio will evolve.

IRR, profitability with capital letters

In Urbanitae, you will see that we use the acronym IRR a lot to refer to how the projects that we have returned to investors are going. The internal rate of return (IRR) is calculated with a somewhat complex formula, in which we are not going to stop. But it has the advantage that, in a way, it standardizes profitability, since its reference period is one year. Thus, we could summarize by saying that the IRR is the total or final annualized return.

In Urbanitae we have returned 18 projects to date. While some have been late, many others have finished ahead of schedule. This is one of the main reasons why many of our projects have a higher than estimated IRR: they returned the investment earlier than expected, thus improving their annualized profitability. In other cases, the IRR increases because the total return increases, even if the final term is the one initially planned. In Urbanitae, the average IRR is now 18%, more than four points above the pre-set target.

For all the above, an attractive investment, in addition to offering a satisfactory combination of profitability and risk – for the investor profile that considers it – will combine return and term well. In general, investments with shorter terms – such as crowdlending projects – will offer lower returns than those that require more patience from the investor – and take greater risks.

How to know the profitability of a project in Urbanitae

Over the past year, the regulator of crowdfunding platforms in Spain, the National Securities Market Commission (CNMV), established a more restrictive criterion to talk about returns. At Urbanitae, our profitability calculation is based on a business plan prepared with conservative assumptions and contrasted by third parties. Even so, as in any investment, no one guarantees that the forecast will be fulfilled.

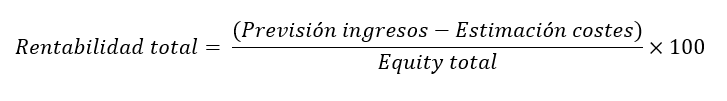

In this sense, and with the certain premise that past performance does not offer reliable information on future returns, the CNMV considered that the estimated returns of capital gains or equity projects could not be made explicit. Instead, the figures that support this calculation could be detailed so that it is the investor who, in each case, calculates the expected return. By now, you’re sure to know them:

In addition, the regulator demanded that two additional scenarios be raised in which things were worse than anticipated. A deviation in costs or in sales prices, or both, but enough for the investor to know what would happen to his money if things went wrong. And what would have to happen to lose money.

In debt projects, it is permissible to speak of estimated profitability. It is understood that, since there is an obligation to repay the borrowed capital within a period and with an interest fixed in advance, it is easier to know what money one will receive. That is because the return is not based on how well or how badly the project is going, but the repayment capacity of the borrower , in this case, the promoter.

Want to know more? Take a look at our section

Learn with Matías

and start investing with peace of mind.