Urbanitae, leader in real estate crowdlending in Spain

Last Updated on 19 June 2024 by Equipo Urbanitae

After remarkable growth in the first half of the year, Urbanitae has become the leader in real estate crowdlending in Spain, with more than 42 million euros financed by the end of June.

It is true that we specialize in equity operations, which offer a good combination of profitability and risk. This is also because, in medium-sized projects, developers often face significant difficulties finding equity partners. The alliance with Urbanitae allows them to free up part of the capital needed to purchase land or start construction and manage more than one development at a time.

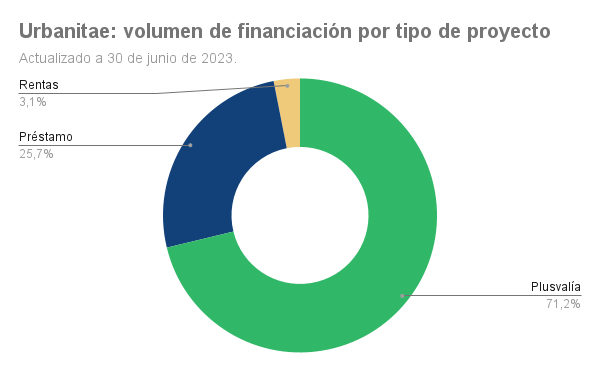

That said, it is true that loan projects have gained more prominence in 2023. While our debt financing grew by 60% throughout 2022, between January and June 2023, it skyrocketed by 140%. Thanks to loans such as the one to Cívitas—the largest real estate crowdlending project in Spain to date—or the two granted to Libra Gestión de Proyectos, each with 5 million euros of debt, the weight of crowdlending in our portfolio has increased from 17% in December to the current 26%.

As you know, debt projects involve pooling Urbanitae investors to grant a loan to the developer. This loan is always at a fixed rate. These projects entail less risk than capital gains projects. Investors are not partners of the developer and, therefore, do not share the typical risks of real estate development: delays in obtaining licenses, increases in construction costs, sales prices…

When selecting real estate crowdlending projects, we focus primarily on the developer’s repayment capacity. It is essential that the developer presents a solidly founded plan to meet the repayment of the loan we provide. Additionally, this plan includes guarantees, which generally always include a first-ranking mortgage guarantee on the asset being developed or on others.

What is the profitability of the leader in real estate crowdlending?

The results confirm that our strategy works. To date, we have returned 16 of the 28 debt projects we have financed. In total, we have returned nearly 18 million euros to more than 6,500 investors. The average IRR (internal rate of return) for these 16 returned projects exceeds 15%. That is, 3.5 points above the target average IRR.

Six of these projects are from one of our investors’ most appreciated developers: Grupanxon. All six are storage unit developments—or storage units and residential units—an asset that has demonstrated its attractiveness within the real estate sector. Thanks to all projects being completed ahead of schedule, the annual profitability figures are outstanding: an overall IRR of 17.8%.

In summary, loan projects are a good way to diversify real estate risk without sacrificing profitability and in a relatively short period. Register for free on Urbanitae and start investing in real estate crowdlending with the leader in Spain.