4. How and where to invest

If you have already checked that your financial house is in order and you already know what you want to achieve with your investments and when, it remains to be asked: what exactly do I invest in? And it is not the same to allocate your savings to buy NFT of the works of Damien Hirst than to put them in Treasury Bills. Luckily, there are many investment options. In order not to mess up, we will simplify a little.

There are two main types of assets to invest in: traditional assets and alternative assets. Broadly speaking, traditional assets include stocks and bonds. On the other hand, within alternative assets we find two basic assets: raw materials and real estate. Indeed, things as lifelong as brick or gold are alternative assets. And pretty safe, besides.

Let’s start with the first ones. You may have suspected that stocks and bonds are all about the stock market, and you’re right. As you know, shares are shares in the capital of a company (which is also called equity). Companies issue shares to finance themselves; Investors buy shares to earn returns on them: specifically, their proportional share of the company’s profits and dividends. If it does, of course. We also often call all this equities, because their value changes – sometimes drastically – and is traded daily in the market.

Bonds are fixed-income securities. They are called that because they are like a fixed-rate loan. When a company or a government needs financing, it can issue bonds. After the term, the company or the government repays that loan with the interest set above. It is common that, while the bond is in force, the investor receives periodic interest – as in an income project. This periodic dividend is often called a coupon.

The Stock Exchange and the Funds

If we are guided by the movies, investing in stocks has to do with individuals in suits frantically telephoning from the parquets. Nowadays investing in the stock market is simpler and cheaper. You can buy shares from home through your bank or an online broker. (The men in suits I was referring to were the only brokers there before…).

The bad thing is that choosing stocks is a complicated task. It requires a lot of dedication – you have to be aware of the current situation of companies – and the results are discreet. The reality shown is that the best path to profitability is not to choose at all. That is, invest not in a handful of companies, but in all those listed on the Stock Exchange. It is the best way to diversify your investment: this way, when some stocks go wrong you can compensate for the risk with those that go well.

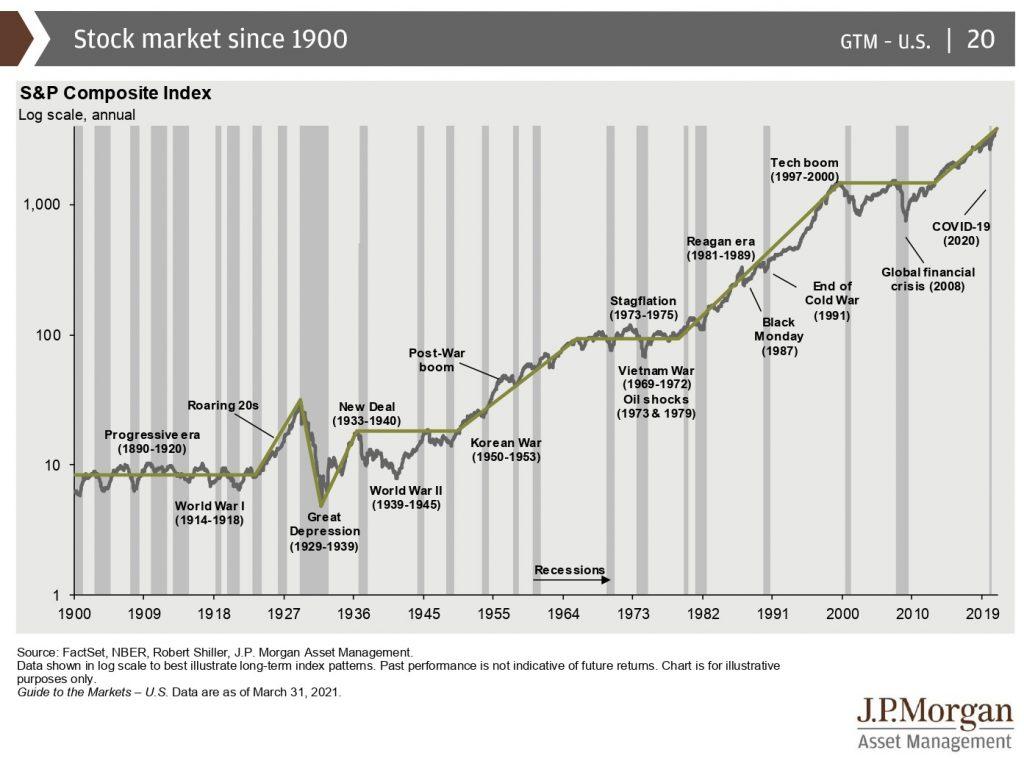

That’s what index funds do. Instead of trying to beat the market – choosing the best stocks – they are content to replicate it. They invest in an entire index, for example, the S&P 500 or the IBEX 35. It is much simpler, it is also cheaper and, above all, it works. Why? Because the market always wins. Despite the crises, in the long term all stock markets rise and the economy grows.

The example of the S&P 500, seen on the chart, makes this clear. As John Bogle, considered the inventor of the index fund, advises: “Just buy the entire stock market. Then, once you’ve bought your shares, exit the casino and stay out. Stick to keeping the market portfolio forever. And that’s what the index fund does.”

These funds are passively managed: the actively managed ones are run by experts who make the stock selection for you, trying to beat market performance. However, beating the market is within reach of very few. “Over 10-year periods,” Burton Malkiel and Charles Ellis explain, “equity investment funds have repeatedly outperformed two-thirds or more of actively managed funds.” And with a much lower cost.

Alternative investment according to Urbanitae

Funds are also the easiest way to invest in alternative assets such as commodities, such as oil; base metals, such as iron or nickel, and precious metals, such as gold or silver. These assets are normally considered a haven against inflation and are a good way to diversify. But their operation is not so simple and they can experience volatility when there are geopolitical tensions – as now.

Therefore, the most appropriate option to start in alternative investment is the brick. We have already told you in the blog how you can invest in real estate. One of the most comfortable options for the investor is real estate crowdfunding. Proposals such as Urbanitae’s also combine the two approaches of the funds, passive and active management. There is a team of experts who filter and select the projects that are uploaded to the platform, but it is the investor who ultimately decides which ones he wants to invest in. And at no cost… Do you dare to try?