What is the secret of sound investment?

Last Updated on 17 January 2024 by Urbanitae

Fifty years ago, the latest edition of The Intelligent Investor, the bedside book for investors around the world, including Warren Buffett, was published. In the last chapter, its author, Benjamin Graham, distills what he believes to be “the secret of wise investing into three words”. He does so at the end because it is the “core concept of investing,” a summary of what defines the intelligent investor.

Well, the secret of wise investing is none other than “margin of safety.” Graham argued that investors should buy stocks or assets when their market price is significantly below their intrinsic value. This value is determined by fundamental analysis, which takes into account financials, cash flows and growth prospects, among other things.

By buying with a margin of safety, investors protect themselves against uncertainty and potential valuation errors. The margin of safety acts as a cushion that reduces the risk of loss in the event that valuation estimates are incorrect or the market experiences downturns. This difference between the price and the actual value of the assets is the margin of safety.

Above all, don’t lose

For Graham, the margin of safety depended on the expected earning power and bond yields. “The margin of safety is the difference between the percentage of earnings on the stock at the price that was paid for the stock and the interest rate on the bonds, and that margin of safety is the difference that could absorb any unsatisfactory events that might occur.”

The key, therefore, is to minimize risk and avoid calamitous losses, an approach we share in this blog. The reason is clear: it costs a lot to recover from a downturn. In his comments on Graham’s book, financial journalist Jason Zweig sums up the importance of margin of safety: “By refusing to pay too much for a stock, you minimize the chances that your wealth will suddenly disappear or be destroyed.”

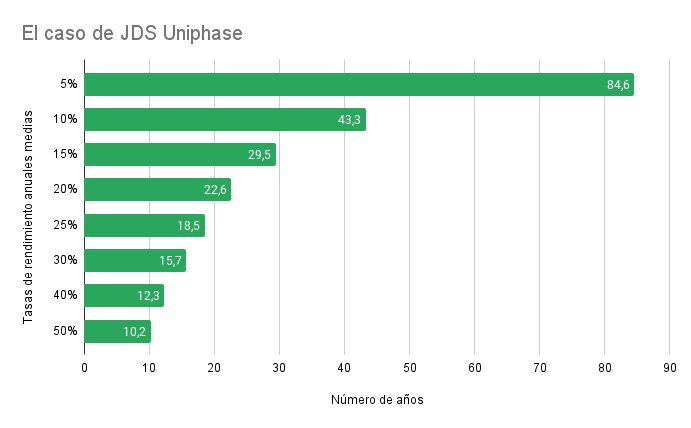

Zweig cites the example of JDS Uniphase, a technology company whose stock price skyrocketed in the dotcom boom of 1999-2000. The company’s stock was worth more than $153 in March 2000. However, at the end of 2002, they closed at $2.47. Even if they then grew at 10% a year, the investor who bought them at their peak would have needed… 43 years to get his money back.

The risk does not only come from “paying too high a price for a good quality stock”. For Benjamin Graham, the main losses “come from the acquisition of low-quality stocks at times when economic conditions are favorable”. “Current earnings” are not the same as the “ability to generate profits”. When the good times pass and current profits disappear, it will become clear that prosperity is not the same as security.

What if I’m wrong?

For Graham, “a true margin of safety is one whose existence can be demonstrated with numbers, with a persuasive argument, and by reference to a set of real experiences”. But even the best analysis can be wrong. That’s why the smart investor must be prepared and insured against loss if his analysis turns out to be wrong.

Fortunately, “for most investors, diversification is the simplest and cheapest way to widen their margin of safety.” As Graham himself explains, an individual stock can perform poorly even with margin in the investor’s favor. “With margin, all that is guaranteed is that there is more likelihood of profit than loss, not that loss is impossible.”

Now, if instead of a single stock we opt for a large number of such securities – that is, securities with a margin of safety – “the greater the certainty with which it can be said that the aggregate of profits will be greater than the aggregate of losses.” That is why diversification is one of the basic rules of investing.