Why are house prices surging once again?

Last Updated on 5 February 2026 by Equipo Urbanitae

In many parts of the world, property prices have skyrocketed, making homeownership an unattainable dream for many. This phenomenon is not isolated and affects both major cities and suburbs. But what is behind this widespread rise in property prices? This article examines the main reasons why property prices are rising.

As The Economist reports, property prices rose by more than 3% year-on-year in China, 6.5% in the US, and 5% in Australia through the end of April. Closer to home, Portugal was the seventh country with the highest price increase in the first quarter of 2024, with a 7% rise compared to the previous year. Poland (+18%), Bulgaria (+16%), and Lithuania (+9.9%) recorded even higher increases.

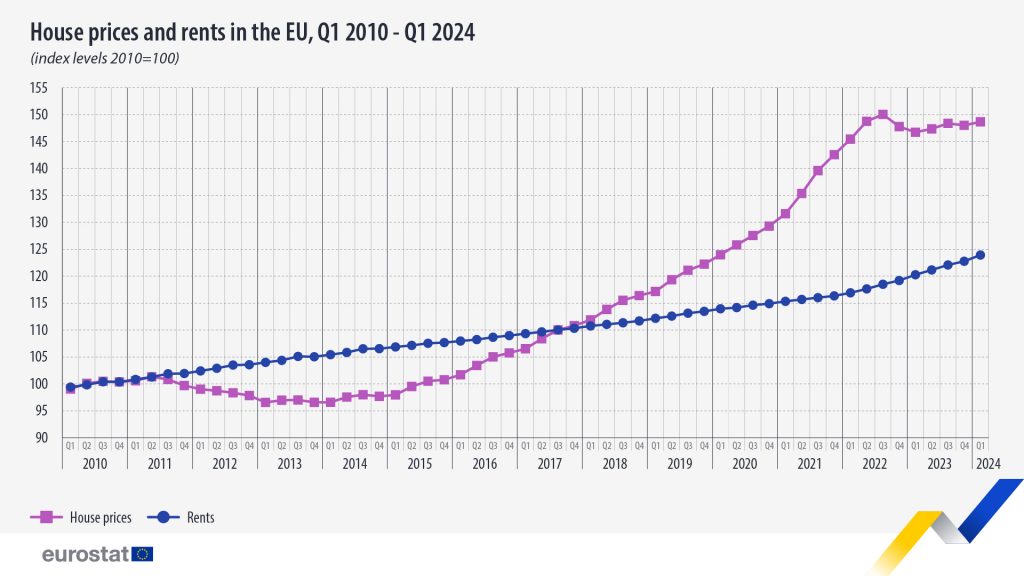

It is true that the increases follow a difficult period for the real estate sector in Europe. After a sharp decline between 2011 and the first quarter of 2013, property prices remained stable between 2013 and 2014. This period was followed by a rapid increase at the beginning of 2015, and prices rose faster than rents until the third quarter of 2022. There were then two quarters of declines and slight fluctuations before a 0.4% increase in the first quarter of 2024.

Why prices are rising

Given the economic context, the real estate sector has demonstrated remarkable resilience. Property prices in Spain continue to rise despite higher mortgage costs and a slowdown in sales. As we know, the limited supply makes it difficult for prices to fall.

The Economist identifies three causes that explain the global increase. The first is immigration. According to the weekly magazine, the foreign-born population is growing at an annual rate of 4%, the fastest since records began. This increase creates higher demand for housing, which drives up both purchase and rental prices.

Secondly, the British publication mentions the sacrifices buyers are making. Higher debt costs mean that mortgage borrowers are cutting back on spending or even dipping into savings to make payments. In some countries, mortgage terms are being extended, which carries the potential risk of not paying off the house until well after retirement.

But the main factor is the economy. Changes in interest rates have made mortgages more expensive, but they have also increased deposit returns. The Economist notes that average wages in wealthy countries have risen by almost 15% since 2021. Generally, these increases have far outweighed mortgage costs, making the market resilient.

Depending on the case, these factors are compounded by the imbalance between supply and demand, the lack of affordable housing alternatives, or rising construction costs. This combination makes addressing access to housing a complex challenge. Without comprehensive collaboration between governments, developers, and communities to create solutions that balance supply and demand and promote affordability, housing will continue to be a problem for millions of people worldwide.