Build an Investment Portfolio Step by Step (and Adapt It for 2025)

Last Updated on 24 November 2025 by Equipo Urbanitae

Investing is no longer just about choosing a product with good returns. In an environment where inflation, interest rates, and financial innovation are constantly changing, building your investment portfolio in 2025 has become an essential skill. It’s not just about spreading money across different options, but about designing a strategy that makes sense for you — your risk profile, your goals, and your time horizon.

1. Understand your starting point: goals, risk, and time horizon

Every portfolio starts with a basic question: what are you investing for? It’s not the same to save for retirement, to buy a home in five years, or to generate passive income in the medium term. Each goal requires a different combination of assets and a distinct level of risk exposure.

Your risk profile determines how much volatility you can tolerate. A conservative investor will seek to preserve capital and obtain stable returns; a moderate one will accept small fluctuations in exchange for higher performance; and a dynamic profile will prioritize growth, even if that means taking on more uncertainty.

Defining your time horizon is also key. In the short term (less than three years), it’s advisable to focus on safe, liquid investments. In the long term (more than seven years), you can include assets with higher growth potential, such as equity funds or real estate projects with capital appreciation.

2. Choose the right assets for your profile

A good portfolio is not built on intuition but on balance. Ideally, it should combine assets that behave differently across economic cycles. In 2025, investment opportunities can be grouped into three main categories:

- Traditional assets, such as fixed income and equities. Bonds are regaining appeal thanks to higher interest rates, while index funds remain an efficient way to participate in global markets.

- Alternative assets, such as real estate, provide stability and diversification. Real estate crowdfunding, for instance, has enabled small investors to participate in projects with different horizons and structures (debt or equity), combining security and profitability.

- Strategic liquidity, which ensures flexibility. Keeping part of your capital available allows you to seize opportunities without having to sell other assets at unfavorable times.

Platforms like Urbanitae offer access to carefully selected real estate projects that can be integrated into a diversified portfolio to provide stability or additional returns, depending on the type of investment chosen.

3. Build a coherent structure and review your decisions

An effective portfolio is not defined by the number of products it contains, but by its coherence. Instead of chasing past returns, what matters is that each asset serves a purpose within the whole. If one fund helps protect you from inflation, another might balance risk with stable income, and another might capture long-term growth trends.

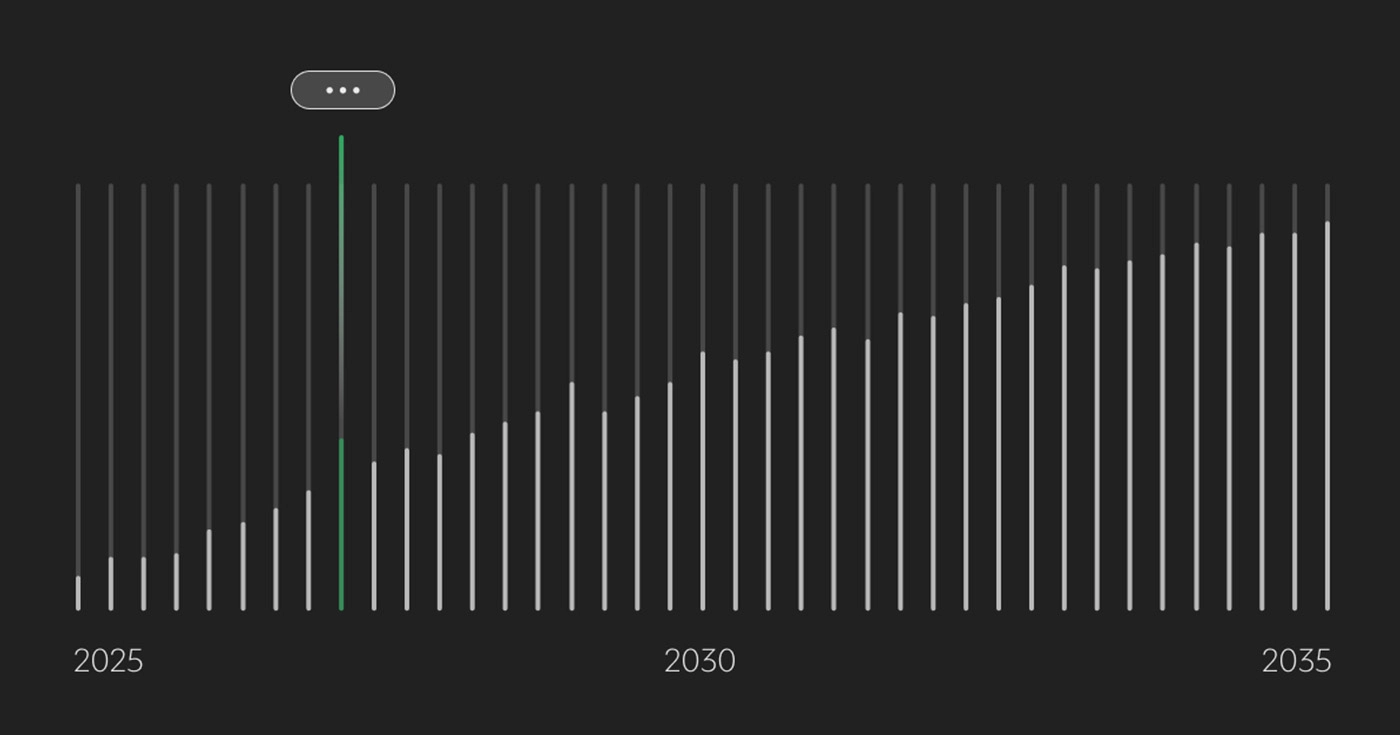

It’s also essential to review and adjust periodically. Markets change, and so do your personal goals. Reviewing your portfolio once or twice a year allows you to rebalance weights, take profits, or strengthen areas with better potential. It’s not about reacting to every market movement but about staying on course with discipline.

4. Invest with a strategic, not emotional, mindset

The greatest enemy of investors isn’t the market — it’s impulsive decisions. A well-designed portfolio should give you the confidence to stick to your plan even during volatility. Instead of trying to guess the best time to invest, focus on consistency: contribute regularly, keep realistic horizons, and avoid reacting to noise.

Smart investing in 2025 will be about combining analysis, method, and purpose. Knowing why you’re investing in each asset — not just how much you expect to earn — will help you sustain your strategy over time.

Conclusion

Building an investment portfolio step by step means understanding your goals, knowing your limits, and structuring your capital logically. In a context where financial innovation opens new opportunities, combining traditional assets with alternatives like participatory real estate investment allows you to create a solid, profitable, and personalized portfolio.

The secret is not to predict the future, but to prepare your portfolio for any scenario. And in 2025, that means having a clear plan, investing wisely, and relying on tools that offer transparency, diversification, and real access to the real economy.