Spanish Real Estate Emerges in the European Context

Last Updated on 19 November 2025 by Equipo Urbanitae

European real estate is moving towards a phase of consolidation and adjustment, in which Spain stands out as one of the most attractive investment destinations. The real estate sector has entered a stage of gradual recovery in Europe following a correction process that began in 2022.

This is described in the Global Trends and Tactics Q3 2025 report by Nuveen Real Estate, which marks a turning point in the sector: the economic cycle recovery, stabilization of interest rates, and reactivation of demand are driving increased transactional activity. However, there is a noticeable disparity between markets. Confidence indicators show that investors have recognized the sustained economic strength and resilience of Spain, the Netherlands, and the Nordic countries, while maintaining a more cautious stance towards Germany, France, and the United Kingdom, each facing particular economic challenges.

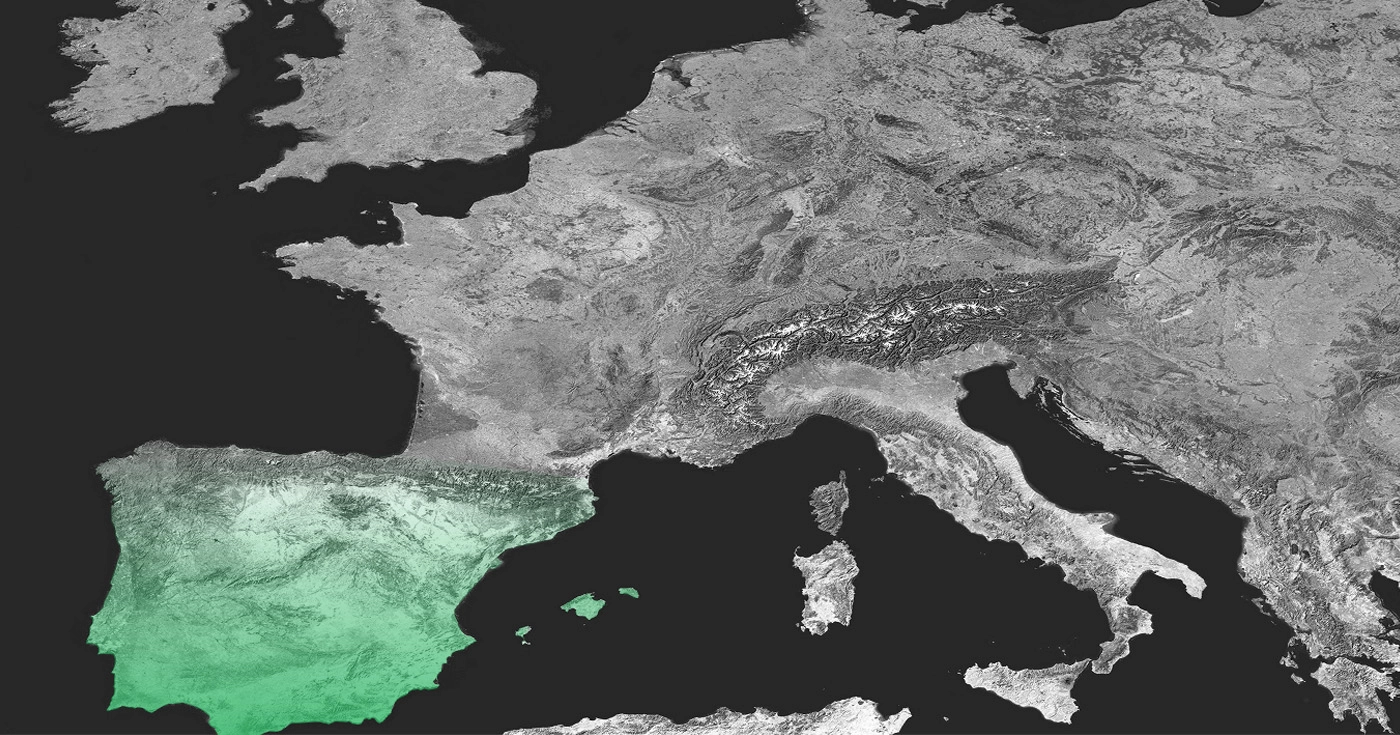

Spain on the European Real Estate Investment Map

According to this report, the recovery of the European real estate market relies on selective investment strategies and more granular analysis by asset type. Investors seek to combine established markets with expanding economies, where profitability potential remains significant. In this context, Spain gains appeal due to its macroeconomic stability, strong domestic consumption data, and the consolidation of its main cities as capital attraction hubs. Our country is positioned as one of the markets with the best balance between profitability and growth, in an environment where economic stability and improved investor confidence decisively influence international capital flows.

A perspective supported by consulting firm Colliers. Its data indicates that in the first three quarters of 2025, investment in Spain grew by 31% compared to the 2024 average, surpassing the Eurozone, which recorded an average decline of 12.6%. During this period, invested capital reached €12.914 billion, with the living, hotel, and alternative asset markets driving Spain’s leadership over Europe:

- The living market grew to over €3 billion in investment, an annual increase of 99%.

- The alternative assets market—including healthcare facilities and data centers—recorded the highest growth, at +329% year-on-year.

- Investment in hotel assets accelerated, with €2.826 billion invested by Q3, 41% more than the same period in 2024.

Colliers also highlights that this exceptional performance is supported by a combination of favorable macroeconomic factors, such as sustained GDP growth, labor market stability, and dynamic consumption.

Strong Investment Momentum in the Iberian Peninsula

CBRE’s analysis aligns with these figures and assessments. The firm estimates that real estate investment in Spain reached €12.9 billion by September, 44% higher than the same period the previous year, marking the third-best historical record, only behind 2022 and 2018. It also states that this growth positions Spain above the European average (+8% year-on-year) and reinforces the Iberian Peninsula’s attractiveness to international investors.

In fact, CBRE highlights that the Iberian market saw a 48% increase in investment compared to the first half of 2024, driven especially by Portugal, which experienced an 81% rise during this period. This strong performance is reflected in the view international investors hold of the Iberian real estate market, as shown in the European Investor Intentions Survey 2025.

In this context, Spain remains the second most preferred European country for investors, while Portugal ranks sixth. Additionally, Spain is the only country with two cities in the top 10 investment destinations: Madrid rises to second place (from third in 2024) and Barcelona moves from seventh to fourth; Lisbon remains in eighth position.